Canada’s national office vacancy rates have surged in recent months, reflecting a growing trend of businesses shifting towards remote work and downsizing their physical office spaces. This significant rise in vacant office spaces has impacted both the economy and the real estate market, prompting concerns among investors and property owners.

According to a recent report by the commercial real estate services firm CBRE, the national office vacancy rate in Canada has reached 17.7%, a significant increase from the pre-pandemic rate of 10.8% in 2019. This increase has been attributed to the widespread adoption of remote work policies by businesses and the government’s efforts to curb the spread of COVID-19.

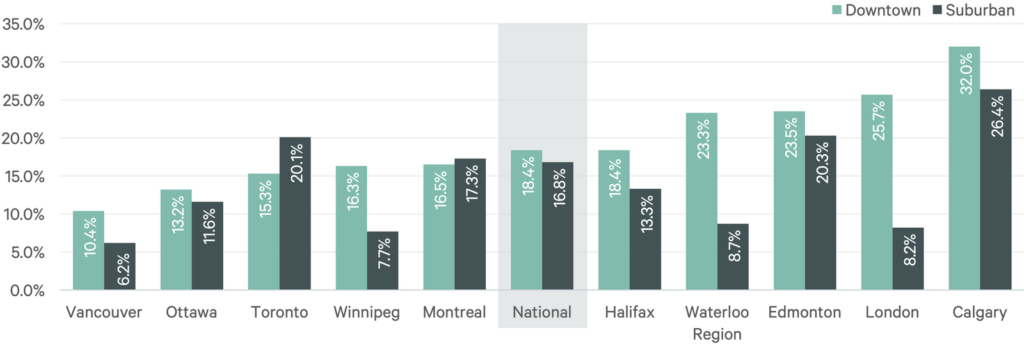

Source: CBRE

Some of Canada’s largest cities, including Toronto, Vancouver, and Montreal, have experienced the most significant vacancy rate increases. Toronto, the country’s largest city and financial hub, has seen its office vacancy rate jump from 6.8% in 2019 to 14.6% in 2023. Vancouver’s office vacancy rate has risen from 9.2% in 2019 to 17.3% in 2023, while Montreal’s rate has gone up from 9.4% to 14.8% during the same period.

This trend of rising vacancy rates has led to a surge in subleasing activity, as businesses look for ways to minimize their operational costs. Subleasing has become increasingly popular, with companies offering their excess office space to other businesses at discounted rates. This has, in turn, created more competition in the commercial real estate market and put downward pressure on rental rates.

The rise in office vacancies has also had an impact on the broader Canadian economy. With fewer businesses requiring physical office spaces, the demand for office furniture, equipment, and commercial construction has decreased. This has resulted in job losses and reduced revenue in industries related to office space and supplies.

Conversely, the increased adoption of remote work policies has fueled growth in the technology sector, as businesses invest in digital infrastructure and tools to facilitate remote collaboration. This has led to increased job opportunities and revenue generation in the tech industry, helping to offset some of the negative economic impacts of rising office vacancies.

The commercial real estate market has also had to adapt to the changing landscape. Property owners and developers have been exploring alternative uses for vacant office spaces, such as converting them into residential or mixed-use properties. In some cases, office buildings are being repurposed as co-working spaces, offering flexible leasing options for businesses that still require physical office space but do not need a full-time, dedicated workspace.

However, not all property owners are eager to convert their office spaces, as the process can be costly and time-consuming. Some landlords are opting to offer incentives to prospective tenants, such as rent-free periods or tenant improvement allowances, in an effort to fill their vacant spaces.

Despite the challenges faced by the commercial real estate sector, some experts believe that the market will eventually stabilize as businesses and property owners adapt to the new reality. As the COVID-19 pandemic subsides and vaccination rates increase, it is possible that some businesses may revert to in-person work, thus increasing demand for office space.

However, the long-term outlook for office vacancies remains uncertain. Many businesses have realized the benefits of remote work, such as reduced overhead costs and increased employee satisfaction, and may be hesitant to return to a traditional office environment. As a result, the commercial real estate market may continue to face challenges as it adapts to this new paradigm.

In conclusion, Canada’s national office vacancy rates have risen significantly due to the widespread adoption of remote work policies in response to the COVID-19 pandemic. This increase has had a ripple effect on the economy and the real estate market, prompting concerns among investors and property owners. While some businesses and property owners have adapted by offering subleasing options or converting office spaces to alternative uses, the long-term outlook for office vacancies remains uncertain.

The future of the commercial real estate market may depend on the extent to which businesses continue to embrace remote work in the post-pandemic era. As vaccination rates increase and the pandemic subsides, some businesses may choose to return to a traditional office environment, helping to stabilize office vacancy rates. However, with many companies now recognizing the benefits of remote work, it is likely that the demand for office space will remain lower than pre-pandemic levels.

In the face of these uncertainties, property owners, developers, and businesses will need to remain flexible and adapt to the changing landscape. This may involve continued exploration of alternative uses for vacant office spaces, such as residential or mixed-use conversions, or investing in digital infrastructure to support remote workforces. Ultimately, the success of the commercial real estate market will depend on its ability to respond to the evolving needs of businesses and employees in a post-pandemic world.